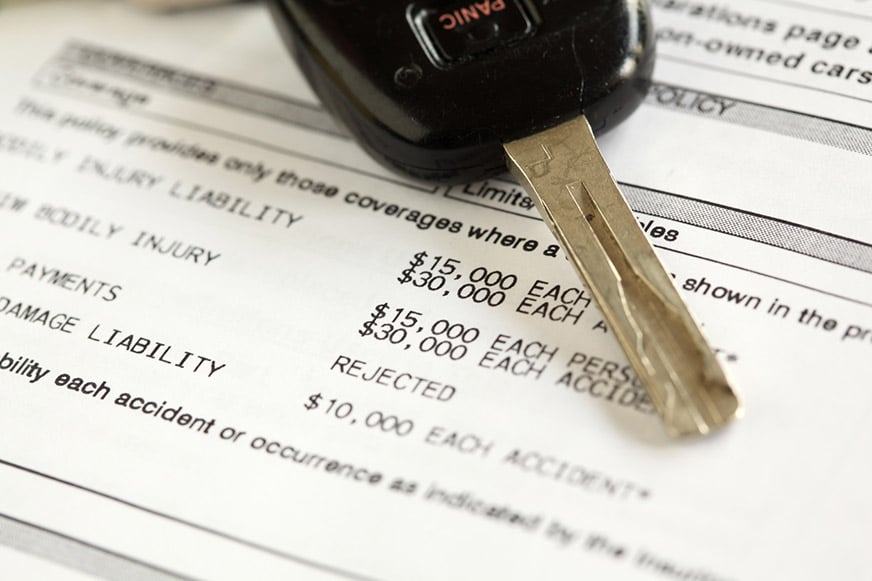

If you drive a vehicle in Florida, you’re aware of Florida’s no-fault laws. Florida is one of a handful of states that makes every vehicle owner purchase insurance. The insurance covers you when you’re in an accident even if you’re the one at fault.

At the heart of Florida no-fault insurance is Personal Injury Protection or PIP insurance. MedPay is another important type of insurance that’s available in Florida. While you may still need to work with an experienced car accident attorney to reach the best resolution to your case, understanding the nuances of insurance can help make it more accessible. Here’s how PIP Insurance and MedPay can help you after a Florida car accident.

What Is PIP Insurance?

PIP stands for personal injury protection. PIP insurance is the meat and potatoes of Florida’s no-fault insurance. It’s the insurance that you have to buy that pays you when you’re in a car accident. It pays you up to the policy limit even if you’re at fault. If you own a PIP insurance policy, it covers you whenever you’re in an accident that involves a vehicle even if you’re a pedestrian or on a bicycle.

Florida law 627.736 lists the rules for car insurance in the State of Florida. The chapter title is “Required personal injury protection benefits.” It says that a no-fault insurance policy must cover at least $10,000 in medical and disability benefits and at least $5,000 in death benefits. To receive personal injury protection benefits, all you have to do is notify your insurer of an accident and your losses. You don’t have to prove that someone else caused the accident.

Related: St. Petersburg Personal Injury Attorneys

What Does PIP Insurance Pay?

When you make a PIP claim, the insurance company pays you for 80 percent of your medical bills up to your policy limit. The lowest policy limit is $10,000. If your injuries aren’t the result of an emergency medical condition, you can receive up to $2,500.

For example, you’re in an accident, and you suffer $1,000 in medical bills. You submit your claim to your PIP insurance carrier. Your PIP insurance pays you 80 percent or $800 minus any deductible. Many policies have a deductible. If you have one, the insurance policy starts paying after you reach the deductible amount.

You can also recover for lost wages. PIP insurance pays you 60 percent of your lost wages up to the $10,000 limit. If your accident is fatal, PIP insurance pays your survivors a death benefit of $5,000.

What Is MedPay Insurance?

MedPay insurance is optional insurance that you can get to supplement your PIP insurance. Since PIP insurance pays only 80 percent of your qualifying losses, MedPay is available to cover the remaining 20 percent. You can also buy a higher policy limit to make sure that your damages are covered if they exceed $10,000.

Why Is PIP/MedPay Insurance Helpful After a Car Accident?

There are a number of ways that PIP insurance and MedPay can help you after a car accident. You can typically receive benefits in a shorter period of time than you would have received them if you had waited to bring a court case.

Also, there’s no inquiry into fault. The only question is your damages. You don’t have to worry that the other side doesn’t have adequate insurance, and you don’t have to worry about the stress of litigation. MedPay coverage costs approximately $100 each year in addition to the costs of your PIP insurance.

How Do I Get Paid?

To collect payment, you must seek medical treatment within 14 days of your accident. You must notify the insurance company of your accident and your medical bills. The insurance company can ask your medical care providers to submit verification. They may request documentation of your dates of treatment, the type of care provided, costs, and an explanation of why the costs for treatment are reasonable. Your employer may also need to fill out a form that verifies your employment and pay.

When you correctly submit a claim, the insurance company should pay you immediately. The payments are overdue if it’s been more than 30 days since you filed your claim. The insurance company has up to 60 days to investigate the claim and determine if they suspect fraud. The medical care provider may charge a reasonable cost for services. To determine what’s reasonable, the insurance company considers prevailing rates in the area and reimbursement schedules with insurance providers.

What Treatments Are Covered?

Generally, any treatment that you receive from a licensed medical facility is covered. Your initial treatment, follow-up care, rehabilitation, and nursing care should be included.

Chiropractic services are covered, but you must use someone other than a chiropractor to certify that you had an emergency medical condition after the accident. Acupuncture and massage therapy are not covered.

What If I’m Having Trouble Getting the Insurance Company to Pay Me?

If you’re having trouble getting the insurance company to pay your benefits, you can bring a legal claim against the company. If you win, you’ll have a court order that requires the insurance company to pay you the benefits that you deserve up to your policy limits.

You can also work with your attorney to write a letter to the insurance company stating your case and asking them to pay you fairly. Having an experienced attorney on your side can help you make sure that you get everything you deserve under Florida’s no-fault insurance laws.

Related: St. Petersburg Motorcycle Accident Attorneys

Contact An Experienced Car Accident Attorney Today

The skilled legal team at Jack Bernstein, Injury Attorneys have helped thousands of clients just like you navigate Florida’s complex no-fault laws. With more than 50,000 cases under our belts, we have the experience and determination to help you pursue your case to the fullest extent of the law.

If you need help dealing with insurance after a car accident, call us at (813) 333-6666 or fill out our contact form to schedule your free case evaluation. There is no fee unless we win.